Reporting & Analysis

View HMRC obligations, liabilities, payments and submitted returns through Dataflow's MTD

Dataflow Clarity ability to setup numerous VAT Codes and Rates which can optionally be set against Products, Suppliers and Customers, to remove data entry errors with automatic calculation and rounding, the VAT reporting could not be made any easier.

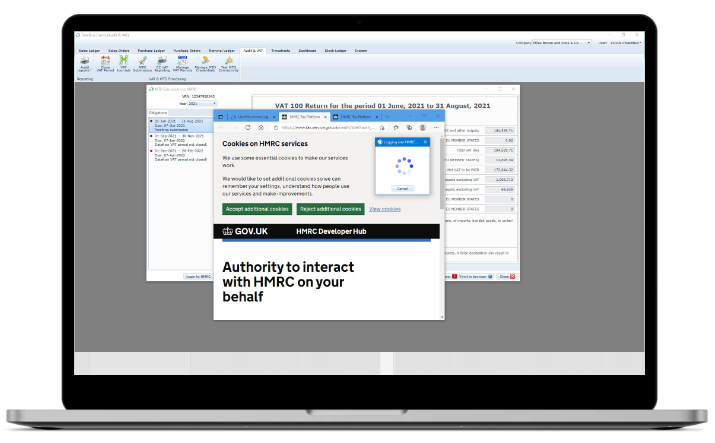

Full integration with HMRC’s MTD systems to make submitting your VAT return as simple as it possibly could be.